Interview series: A world where you do not have to ask for the WiFi password anymore!

We are so used to everything being automated. Yet the connectivity is still lacking. Why cannot connectivity extends everywhere in every type and form? Maybe it can!

80 % of today's total mobile traffic is generated indoors.

That is the quote with which we end our interview with Morgan Curby of Proptivity. Morgan adds “This is some statistics you should really be aware of.”. Indeed, it comes natural to me as well that most of my Reddit scrolling happens indoors. I also occasionally scroll in public transport. What is that compared to scrolling while sitting on the couch or lying in bed?

At the same place where 80% of the mobile data is created we have another issue. The figure illustrates the bandwidth versus penetration dilemma that creates the indoor coverage issue. There is even a not shown third dimension to the problem that is the population density. Higher the population density the more bandwidth is required to serve these users. At the intersection of these three points, multi-floored residential buildings, with latest isolation material to keep heat inside and the cold outside, creates the biggest issue for telecommunication service providers.

Proptivity is a Swedish startup focusing on providing indoor connectivity. The aim is to provide seamless cellular coverage indoors without causing you to go to the trouble of getting WiFi access or any other wireless technology for that matter.

Technologically, the infrastructure to enable this deployment is already there with the 5G standards. One might say in many domains 5G is ahead of the market reality. It is up to market makers like Proptivity to create the market for such value creation.

Their most recent and promising customers as far as I understood are co-working spaces. In co-working spaces multiple companies use the WiFi solution to do all kinds of business. In case a complex indoor wireless network management is not in place this raises concerns from the tenants.

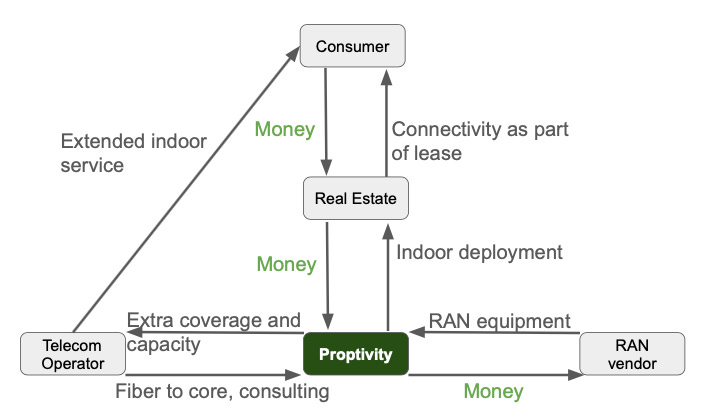

The thing I find most fascinating is their business model involving real-estate owners, RAN vendors, telcos and consumers. It creates a challenging business model but maybe one that is required to unlock the value created for indoor communications. Let us go through the interview to unlock the story leading to this exciting business model.

Subscription is for free and keeps our motivation to go on. Help us with a click.

1. Indoor connectivity issues

Morgan starts explaining the high-end retail and malls that have indoor networks today. He says “ They started with guest WiFi. However, what they learned quickly is that the consumers hate logging into WiFi”. I myself also do not like to ask for the WiFi password. Sometimes the WiFi is simply intended for guests to use but sometimes that is not the case and the business owner is left with the choice of rejecting a customer request. Moreover, not every business is able to monitor the customer activity to avoid a customer downloading some pirated content.

The competitors for retail connectivity are companies that offer guest WiFi for retail through some software such as Beonic. Their website underlines that the customers tend to stay 65% longer in a shop. I would expect that price-wise it would be hard for Proptivity to compete with such WiFi solutions.

Secondly, office buildings are underlined as a driver for the need of high quality connectivity. Which one of us did not have to close the video during a meeting in the office? Or had connectivity issues during a meeting that we hosted and had to joke saying “ I had to take this from home maybe, eh eh eh.”. Some companies even ask employees not to use WiFi on their phones. This is especially an issue if WiFi is used to some extent for the systems running like an automation system depends on it e.g., in factories or warehouses.

Technical comment: Here, Morgan underlines the main issue of using an unlicensed spectrum. The unlicensed spectrum can be used by anyone at any time and there is no guaranteed way to deal with interference compared to cellular networks that runs on licenced spectrum.

Finally, he underlines a different issue that is how to guarantee that employees stay secure while doing remote work. I would say that is slightly related to their business model. He has in mind that employees get a laptop that supports cellular networks only and the employee behavior in the office is already trained to get access through cellular networks. However, I can see that employees would complain that they have bad connectivity from home. So they would ask for technical and economical support to get connectivity at home. Or they would be forced to come to the office.

2. Technical setup

He says that we only work with Ericsson equipment, they are based in Sweden that makes sense.

“We have Ericsson Dots placed all around the building. We run a non stand alone system (NSA) where 5G runs on N78 and 4G runs on band 1 and band 3. This gives us access to a total band of 400 MHz.”

Technical comment: n78 is the TDD band that runs between 3.3 GHz to 3.8 GHz with a total bandwidth of 500 MHz. Band 1 is the carrier frequency of 2.1 GHz and Band 3 is 1.8 GHz FDD bands with 80 MHz bandwidth on each.

Post-interview comment: I did not ask why they have gone for NSA. I think it is a market choice. Most of the phones did not support stand alone 5G for a long time. And the available phones mainly supported NSA. I guess to enable interoperability with most phones they have gone for NSA.

I asked if there is a slicing solution to enable the sharing of the frequencies, he did not stay on that and said that the solution enables sharing of frequencies that the Dot can deliver.

He says all the Dots connect to the same base band unit and with a fiber link connects to the core network of each operator. He adds that the dots can do 4 by 4 MIMO which gives a throughput of 2-3 GBits per second throughput at each Dot location.

Post-interview comment: I did not ask how many Dots a baseband or RF unit can support. I have seen another indoor deployment. I would expect that the baseband unit should be able to support up to 20 dots probably depending on the capacity.

“We are working on it but a shared BB unit is not there yet. We provide a dedicated BB solution for each operator. Each operator goes with an S1 interface directly to their core network over a secure line. ”

Business comment: A quick search turns out that baseband unit prices vary between 10k to 100k €s. I am not sure how much high end BBUs they have to use but not being able to use shared BBUs will probably impact their pricing quite a bit. On the other hand as they are the market makers probably price is not the main issue for initial customers.

Technical comment: As the operators go with S1 interface to their core network then the operators use EN-DC version of the NSA setup, where the 4G core network is used with 4G radio as the anchor and 5G is used as an additional capacity link.

Private comment: We were renovating a 80 sqm flat and wanted to have Ethernet cabling in every room. The quote we got was 5k € for such a small project.

He says that the capabilities to be deployed are decided by Proptivity and it is up to the operator to manage it. He excitedly adds that the antennas are active elements and the operators can benefit from trying and combining the indoor capabilities with outdoor capabilities.

Speculative comment: One can also speculate that if there is enough 4G or 5G coverage coming from outdoors the same setup can also be achieved using the coverage from outdoor as the anchor link while indoor 5G radios provide the capacity link. In this case the 5G can go with the X2 interface to the nearest base station.

Of course after one goes to the trouble of deploying indoor coverage, it probably matters a little to deploy 4G with 5G or 5G only.

3. Current use-cases

In the business they run I see that it would be great to be part of the deal from day 1. A big real estate project where the building can be designed considering radio coverage and the antennas can be easily integrated to the architecture. So I ask if they have many greenfield deployments. He answers that it is mainly a brownfield deployment. He adds commercial properties, residential offices, retail, hospital and transport. “In office and retail only 6% have high end cellular coverage.”

Quote: In office and retail only 6% have high end cellular coverage.

Him mentioning the hospital indoor coverage brings me to my first internship where I was interning at MITEL and visiting hospitals that had issues with DECT phones that they have previously deployed. DECT is short for Digital Enhanced Cordless Telecommunications. Mainly it is used for the pager systems that you have seen in many series like Dr. House. After I shared my story with him, he said that eventually the indoor coverage can replace the DECT system. A private indoor operator that has its own SIM card or eSIM for that matter can run this service fully on cellular phones. This reminds me of Elena Neira quote “Mobile is eating the world.”.

On the topic of private operators he adds that train companies want to be a private operator. We are already aware that many train companies already sell in-train connectivity packages. It is logical that they want to sustain that model. He underlines, we do not want to be an operator. He gives Highway 9 as an example of a startup coming up in this direction.

Business comment: They said they are not working with a designated partner to run private networks. This is a business opportunity to be an interface between use-case owners like hospitals and neutral hosts like Proptivity.

He adds that “ 40% of people that sets up WiFi do not change their admin passwords, making them completely prone to hacking.”. A most prominent use-case he sees is co-working where typically real-estate is leased to companies. These companies use the internet infrastructure available at co-working spaces. The WiFi password is even shared in the corridors, he says. (I have gone and taken a picture indeed.)

Image I took from the co-working space where a friend works

Technical comment: Such WiFi systems where password and the SSID is shared openly is prone to man in the middle (MitM) attacks. One example of MitM attack is where another entity sets up the same WiFi network and you connect to that WiFi instead of the one advertised on the wall as it is almost the same to your modem. Then MitM can re-direct you to other websites, for instance to a PayPal clone if you are accessing PayPal, to steal your username and password.

He says that company specific secure connectivity can be sold with a fair price. “You can think of it as Enterprise IT as a service.”, he adds.

How would one deliver cellular access to companies in a co-working space?

Directly to all laptops. (Too futuristic for now even some laptops support this.)

To the cell phones that one can hotspot. (A hacky solution.)

With a USB dongle connected to laptop. (An ok alternative. I do not know how good these things work.)

With a 5G - WiFi router. (Same solution of current WiFi.)

If you liked the story please share and help!

4. Business model

Proptivity is backed by Stronghold that is a real-estate investment group. Thus, their main customers are real-estate companies and indirectly real-estate customers. What I find most interesting is their interaction with operators.

I told him, “You are deploying coverage and capacity for an operator.

You are deploying a communication service for customers.

You are deploying infrastructure for the real estate company. Who would pay for this? “

Morgan answers, everyone in a way!

He lists that the operator pays with the fiber connection to their network and the manhour related to the operational setting support. Real estate company pays for the indoor deployment and the customer to the real estate company with increased lease cost.

Post interview comment: I actually did not think of the service or monitoring aspect but that is one thing neither the real estate company nor the operator wants to deal with. I would expect that Proptivity also sells a service along the infrastructure. Or maybe they expect their vendor to offer such a package directly to the real estate or over operator. This might be another business idea coming from this new market to be created.

He says that we also explored the possibility that telecom operators would pay but there is a low margin for the operator in the indoor coverage business. He said that the revenue per sqm per year is around 10 € while in real estate in Sweden the revenue per sqm per year is around 500 €. It just seemed like a better margin to add in real estate cost for the consumer to pay. I think he is indeed approaching from the right angle considering monthly home internet costs 30 €. Ideally, the monthly cost should converge to be part of a personal mobile package. However, this requires that the operator also takes an active role in turning this business around.

I am quite sure that the Proptivity business model will evolve many times throughout its life-time to find the right balance. But they have a quite strong start taking the high-end real-estate as the main customer to deal while being backed up by Stronghold.