Blog series: RAN sharing for tower companies

A business model build up and analysis. Tower companies are neutral hosts with a leasing to MNOs.

Mobile Network Operators (MNO) own and control the radio spectrum they’ve licensed. And to be able to provide their services, the complete set of physical requirements for a functional Radio Access Network (RAN) was needed.

Subscription is for free and keeps our motivation to go on. Help us with a click.

An MNO typically used to lease a site in a geographically advantageous position, install racks with radio hardware, batteries to sustain them in case of power failure, cooling to ensure the temperature is maintained within operating limits, security to preserve said hardware from tampering or from being stolen, antenna masts and antennas, civil works projects in order to establish a wired communication to the site (FTTN), maintenance and repairs, monitoring, and so on. Each tower site also needs the local authority’s permission to operate: an individual license for each site can be required.

Considering the number of towers sites needed to provide sufficient coverage for the MNO’s services to be useable, marketable and profitable, the previous enumeration of physical and bureaucratic requirements is a tremendous barrier of entry for a new MNO. The historical phone companies, often still owned by their respective nation, were in general the only ones capable of deploying a RAN.

Are tower companies independent?

Looking to offload, MNOs created their own tower companies which oversee some of the tasks mentioned above. In particular, the site itself, the mast, power delivery and rack housing. Tower sites come ready to use; an MNO now only has to install their radio equipment and antennas. However, those tower companies usually did not become independent and remain to this day attached to their respective MNO. Nonetheless, not all tower companies were originally part of an MNO; many were formed by external groups. This is the case of American Towers and Cellnex: both tower companies were never part of an MNO yet top today the chart in number of tower sites.

If you liked the story please share and help!

The advent of MVNOs

Since the deregulation of the telecommunications sector, Mobile Virtual Network Operators (MVNO) can lease a share of the MNO’s existing infrastructure since they do not possess the necessary license to deploy and manage radio communication hardware. Although the exact relation between MNOs and MVNOs will vary according to the regulations of the country in which they operate, multiple MVNOs have been entering and leaving the market thanks to the now much lower barrier of entry.

Other than managing the infrastructure they lease, an MVNO’s only requirement is to produce its own SIM cards. Nonetheless, some companies do own non-radio infrastructure in order to reduce the cost of leasing and provide better services to their customers thanks to the acquired flexibility and potential for expansion compared to basic SIM-only MVNOs. The main advantage of an MVNO compared to an MNO is in the radically lower pricing since they do not have to buy their own hardware. Moreover, the network is ready to use today, there is no delay needed to build new sites and expand coverage.

Some MNOs created their own MVNOs and compete with other MVNOs, including the ones they lease their own infrastructure to, giving themselves an advantage over the others in terms of lower lease or priority in case of saturation. There are also particular cases of hybrid operators where it is not clear if they’re an MNO or an MVNO.

Neutral hosting

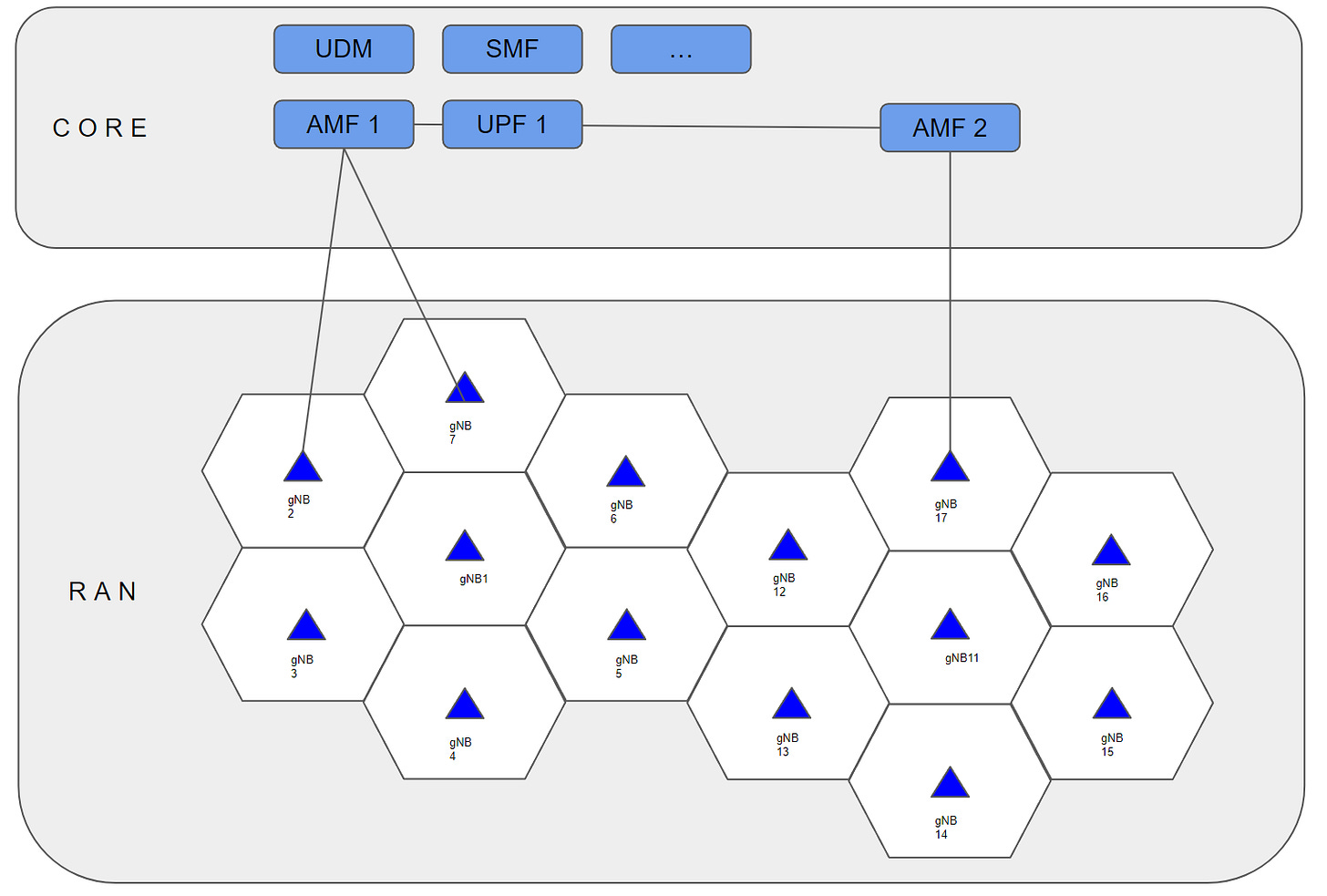

To meet the high demand for high-speed connectivity, tower sites deployment soared while MNOs and MVNOs battled; it is not in the MNOs best interest to provide MVNOs a fully equal access to their own spectrum. And while a tower company cannot lease its infrastructure to MVNOs, it can certainly lease it to multiple MNOs. Sharing the cell towers and fibre to the network is highly beneficial as it allows good network coverage without having to build new infrastructure for each provider. This means lower costs and faster scaling their coverage by using existing tower sites. For a tower company, being a neutral host means a multiplication of leases and therefore a significant increase in revenue.

The key market drivers of this business model are a continuous rise in demand for cell phones, investments in 5G upgrades and coverage, and government subsidies for high-speed internet services in rural areas. Since the current model proved so effective, neutral hosts are now expanding into some active elements of the network: antennas, small cells, last-mile fibre connections, and data centres.

References:

https://stlpartners.com/articles/private-cellular/what-are-neutral-host-private-networks/

https://www.nokia.com/thought-leadership/articles/neutral-hosts-path-to-5G-profitability/